Europe Indoor Farming Report 2025: Trends, Investment, and Technology Insights

Unlock Key Data on Europe's Indoor Farming Landscape

What’s Inside the Europe Indoor Farming Report?

Welcome to the official landing page for the Europe Indoor Farming Report 2025, co-authored by Sepehr A. Achard & Thea-Isabella Otto. This report provides one of the most comprehensive overviews of the indoor agriculture (Greenhouse & Vertical Farms) sector across Europe—covering market forecasts, investment activity, technological innovation, and regional insights. This page is for those seeking insights on Europe Indoor Farming, Europe Vertical Farming, and Europe Greenhouse trends and strategies.

Following the success of our previous publications—including other Indoor Farming Reports and the USA Indoor Farming Report—the European Indoor Farming Report 2025 offers a region-specific analysis of the evolving indoor agriculture landscape across Europe.

Discover how greenhouses and vertical farms are evolving in response to economic, technological, and policy trends.

📈 Market Trends & Growth Forecasts

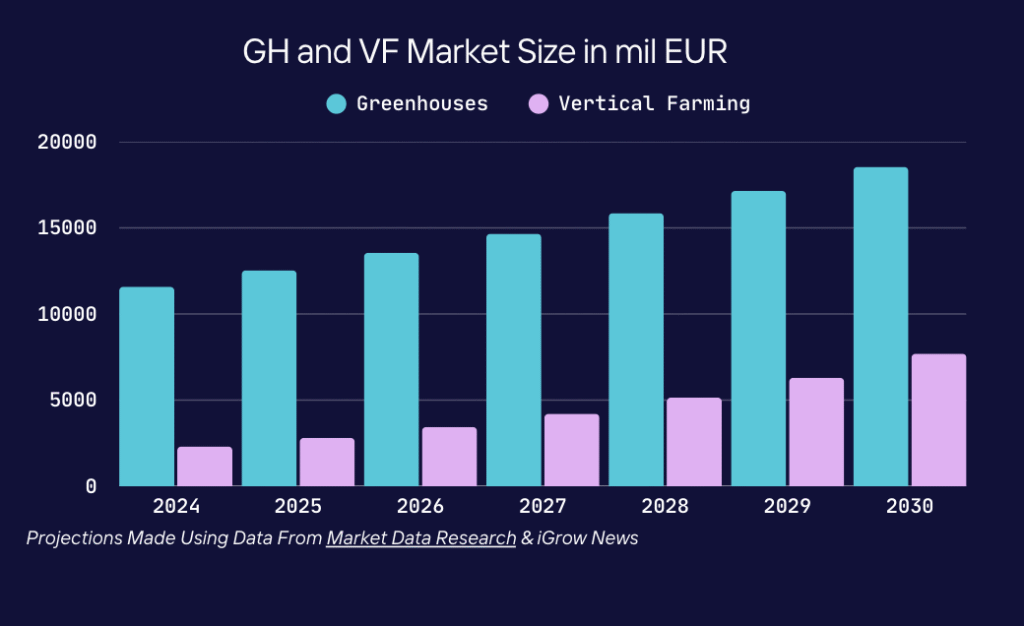

- 22.2% CAGR projected for the European vertical farming market but it still needs to overcome major hurdles related to high CAPEX & OPEX

- 7–8% CAGR expected for indoor farming solution providers (hardware, software, automation)

- Greenhouses remain the dominant model, though increasingly impacted by energy costs, labor shortages and dependence on public funding

- Industry consolidation accelerating, with hybrid vertical-greenhouse models gaining traction

- $123.8 million raised between 2024 and 2025 across Europe

- Major deals: Planet Farms x Swiss Life, IGS, GrowUp Farms, AISPRID

- M&A highlights: TTA-ISO, YASAI-GreenState, DENSO-Certhon

🤖 Automation & AI Integration

- The analysis uses a modified version of the SAE automation levels, adapted to indoor farming by OnePointOne and published on Agritecture in 2019.

- Most European greenhouses currently operate at Level 3, featuring basic mechanization like conveyor systems and semi-automated climate control.

- The sector is steadily moving toward Level 4 (Adaptive Automation), where AI and robotics handle more complex tasks such as monitoring, logistics, and precision interventions.

- During the 2019–2021 growth phase, some vertical farms attempted to leap directly to Level 5 (Full Autonomy)—largely to reduce labor dependency.

- However, rising energy costs and unproven ROI led many operators to scale back and recalibrate toward cost-effective Level 4 models.

- Today, the focus is on balancing automation with reliability and economic feasibility, especially in high-CAPEX environments like vertical farms.

💡 LED & Environmental Control Technologies

- Würth Elektronik’s modular Breeding Station

- Sensor-driven dynamic lighting strategies

- Energy savings through precise light spectrum targeting

🌱 Crop Trends

- Greenhouses: Tomatoes (36%), leafy greens, and fruiting vegetables

- Vertical farms: Microgreens, herbs, edible flowers, strawberries (early-stage)

- Focus on breeding programs, CRISPR-based crops, and peat-free media

📜 Policy & Subsidy Landscape

- Analysis of CAP and Horizon Europe frameworks

- Reliance on subsidies in France and the Netherlands

- Need for reform in funding access for vertical farms

A Landscape Of Indoor Farming Solution Providers In Europe

This map is interactive, you can click on it and discover their profile in our directory. Don't see your company? Feel free to add it in our agtech directory.

The European Report Partner Insights

Why This European Indoor Farming Report Matters

Whether you’re an investor, policymaker, operator, or technologist, the 2025 Europe Indoor Farming Report offers:

- Verified data from top sources like Rabobank, Market Data Forecast, and iGrow News

- Expert insights from market leaders

- Regional breakdowns to support expansion strategies

Get the report. Understand the future. Make informed decisions.