Key Takeaways

- Capital flows in agricultural carbon markets and regenerative agriculture are heavily concentrated in North America and Europe.

- Corporate and private capital dominate agricultural carbon market financing in North America, while Europe relies more on policy-aligned funding structures.

- Public and development finance play a larger role in supporting regenerative agriculture adoption in emerging markets.

- Investment patterns reflect the maturity of MRV, legal, and financial infrastructure rather than agronomic potential alone.

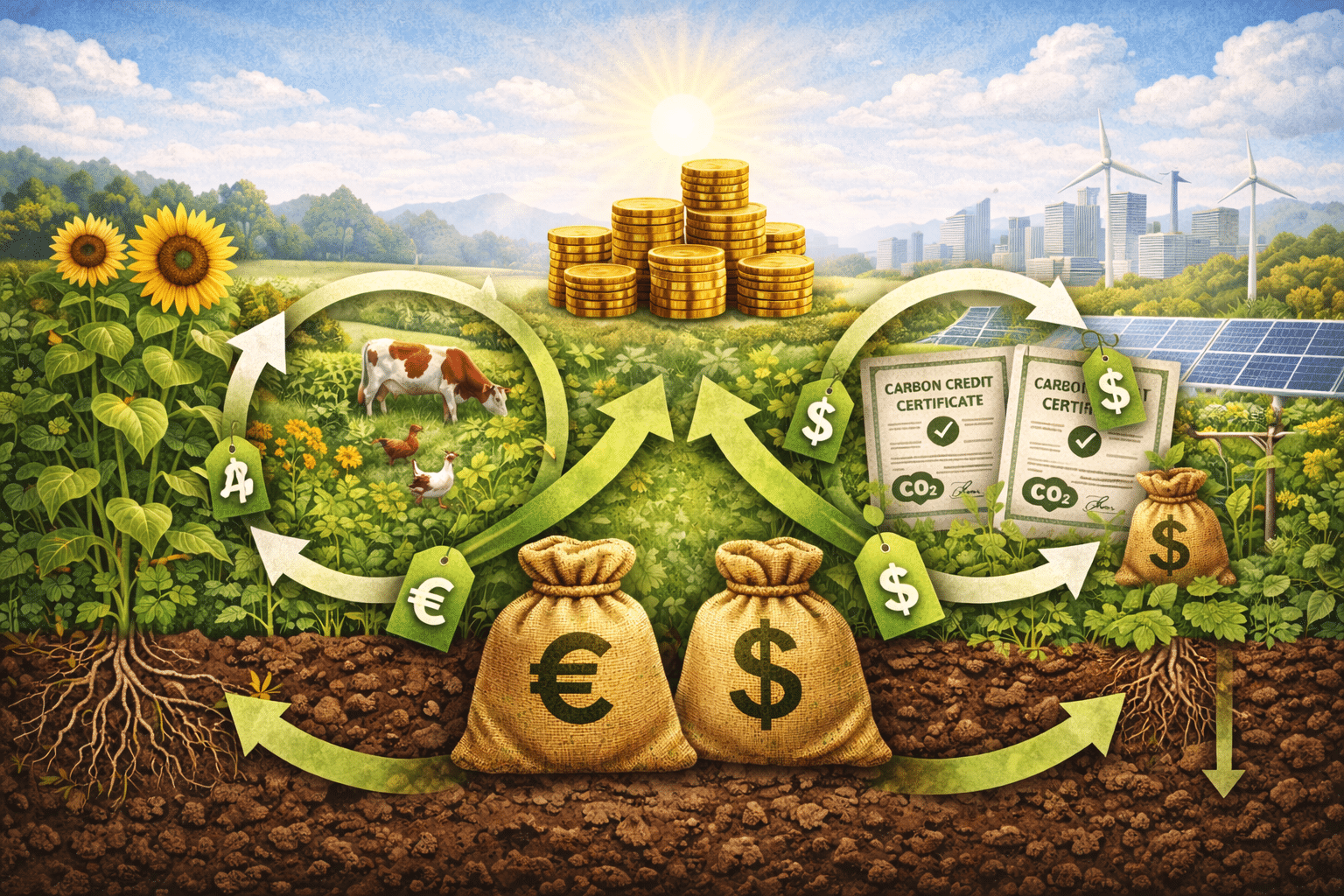

- Capital flows in agricultural carbon markets and regenerative agriculture differ significantly by region and deployment objective.

Carbon Markets Capture a Disproportionate Share of Climate Capital

Data recorded in the iGrow Database indicates that capital flows in agricultural carbon markets and regenerative agriculture are unevenly distributed, with carbon credit–linked projects attracting a disproportionate share of disclosed funding. Investment activity spans venture capital, private equity, project finance, corporate initiatives, and government-backed programs tied to soil carbon, afforestation, grasslands, and biochar.

North America accounts for the largest share of disclosed capital. Funding in the region includes large-scale public investment programs, private financing for afforestation and soil carbon projects, and corporate-backed regenerative initiatives embedded within supply chains. This reflects a market environment where verification systems, contract enforcement, and long-term buyers are well established.

Regional Differences in Capital Allocation

In North America, capital deployment is predominantly driven by corporate and private investors. Food companies, agribusinesses, and financial institutions allocate capital to address Scope 3 emissions, secure long-term supply, and manage operational risk. Venture funding and non-recourse project finance further support platform growth and large-scale aggregation.

Europe shows a different funding profile. Capital flows are more closely aligned with policy frameworks, certification readiness, and compliance-driven objectives. Structured investment vehicles, early-stage funding rounds, and grant-backed programs feature prominently. Following the verification of its AgreenaCarbon Project under Verra standards, Agreena stated that scaling carbon farming in Europe depends on “long-term capital aligned with robust standards and farmer participation.”

In Asia, Africa, and Latin America, capital flows in agricultural carbon markets and regenerative agriculture are smaller in absolute terms and primarily public or project-based. Development banks, government-backed funds, and blended finance mechanisms dominate. These investments are typically aimed at improving yields, resilience, and input efficiency, with carbon revenues positioned as a secondary or enabling component.

Regenerative Agriculture Follows a Different Investment Logic

While carbon markets attract capital where monetization and verification are feasible, regenerative agriculture investment often follows a different rationale. In emerging markets, funding prioritizes productivity gains, soil health, and farm-level resilience rather than immediate credit issuance. As a result, regenerative practices expand even in regions where carbon markets remain limited.

This divergence explains why capital flows in agricultural carbon markets and regenerative agriculture do not move in parallel, despite being closely linked in policy and industry discussions.

Infrastructure Determines Where Capital Flows

Across all regions, capital allocation follows infrastructure readiness. Where MRV systems, legal clarity, and long-term buyers exist, private capital is more willing to engage. Where these conditions are absent, funding tends to remain public, concessional, or pilot-focused.

As one investment manager noted during a recent fund launch, “capital follows certainty—where outcomes can be measured, verified, and financed with confidence.”

Read the full data-driven analysis:

https://network.igrownews.com/c/igrow-market-reports/regenerative-agriculture-mapping-market-activity-capital-and-deployment

Stay informed on agricultural carbon markets and regenerative agriculture:

Subscribe to iGrow News newsletters at https://igrownews.com/subscribe