Key Takeaways:

- New Crop Insurance Solution: DAS introduces a crop insurance solution aimed at improving accuracy and reducing risks for insurers and farmers in Australia.

- Technology Integration: The solution uses machine learning, automapping, and geospatial data to reduce premium leakage, prevent policy errors, and minimize fraud.

- Industry Challenges: Addresses the crop protection gap, where 60% of insurable crops globally remain uninsured, and aims to mitigate the increasing costs of insurance due to climate change.

- Benefits for Stakeholders: Provides enhanced visibility for insurers and competitive rates for farmers, aiming for a more sustainable and efficient insurance market.

Digital Agriculture Services (DAS) has introduced a new crop insurance solution designed to address growing climate change-related risks and financial losses for Australian farmers. As extreme weather events lead to more insurance payouts, DAS aims to provide insurers, underwriters, brokers, and loss adjusters with a more accurate, data-driven approach to crop insurance.

Improved Accuracy and Fraud Prevention

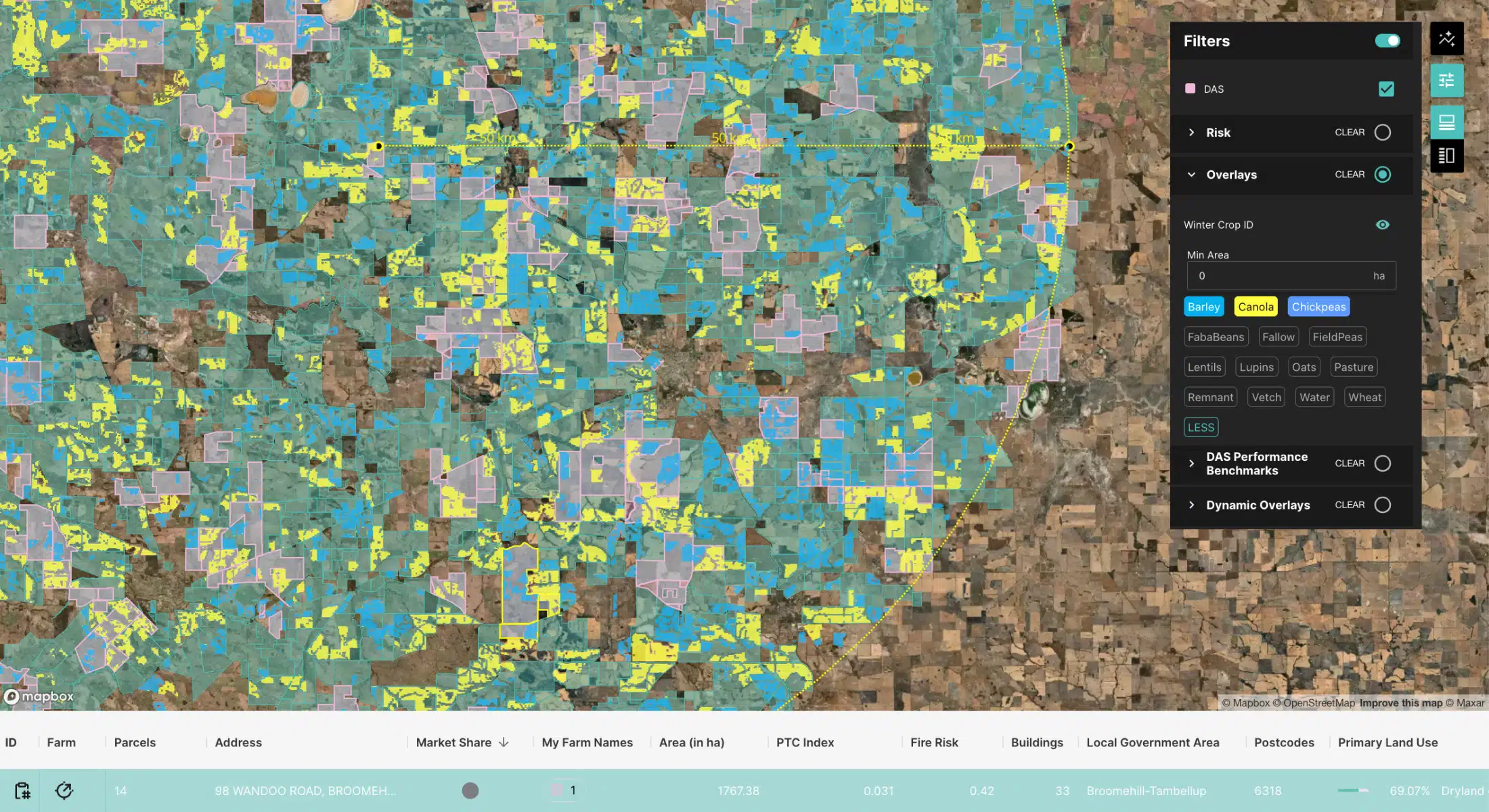

The Digital Agriculture Services solution leverages machine learning, automapping, and geospatial data to enhance the accuracy of crop insurance policies. By spatially identifying insured paddocks and verifying crop types and yields, it helps prevent premium leakage, reduce policy errors, and minimize fraud. The solution also speeds up the claims process, benefiting both insurers and growers.

“Our goal is to prevent premium leakage, reduce mistakes in policy issuance, and streamline claims,” said Anthony Willmott, founder and CEO of DAS. “This solution provides almost full visibility on insured properties, benefiting both insurers and the farmers they protect.”

Addressing Under-Insurance and Premium Leakage

One of the key challenges DAS addresses is under-insurance, a significant issue in Australia’s agricultural sector. Approximately 60% of insurable crops globally were uninsured in 2022, contributing to a $US113 billion crop protection gap. In Australia, 21% of farm businesses are classified as cropping farms, and the cost of insurance is often cited as a deterrent to broader coverage.

Willmott added that the solution offers benefits for insurers looking to reduce loss ratios and costs while giving farmers access to more competitive insurance rates.

Enhancing Global Scalability and Adoption

DAS’ new solution can be integrated with traditional farm insurance or used as standalone crop insurance, improving the availability and affordability of insurance for farmers. The company also plans to scale this solution globally, using Australia as a test case for how geospatial data can enhance crop insurance without the need for government subsidies.

Digital Agriculture Services has a strong track record in providing geospatial data solutions for agriculture, working with partners like IAG, Guidewire, and Insurance Facilitators. Its grain intelligence models, powered by satellite technology, have helped with risk mitigation, food security, and trade decision-making across the globe.

1 Comment