Key Takeaways

- Leaders participating in World Agri-Tech Dubai highlight the importance of integrating inputs, markets, and finance through “last-mile” platforms.

- Digital inclusion, satellite-based credit scoring, and AI advisory tools are reshaping smallholder finance across Africa and the Middle East.

- Mastercard, FMO, Catalyst Fund, and CGIAR share models demonstrating measurable improvements in yields, income, and climate resilience.

- Early-stage innovators are combining fintech, insurance, and agronomy to deliver scalable and affordable financing pathways.

- Speakers emphasize that smallholder finance must be inclusive, ecosystem-driven, and co-designed with farmers to achieve long-term impact.

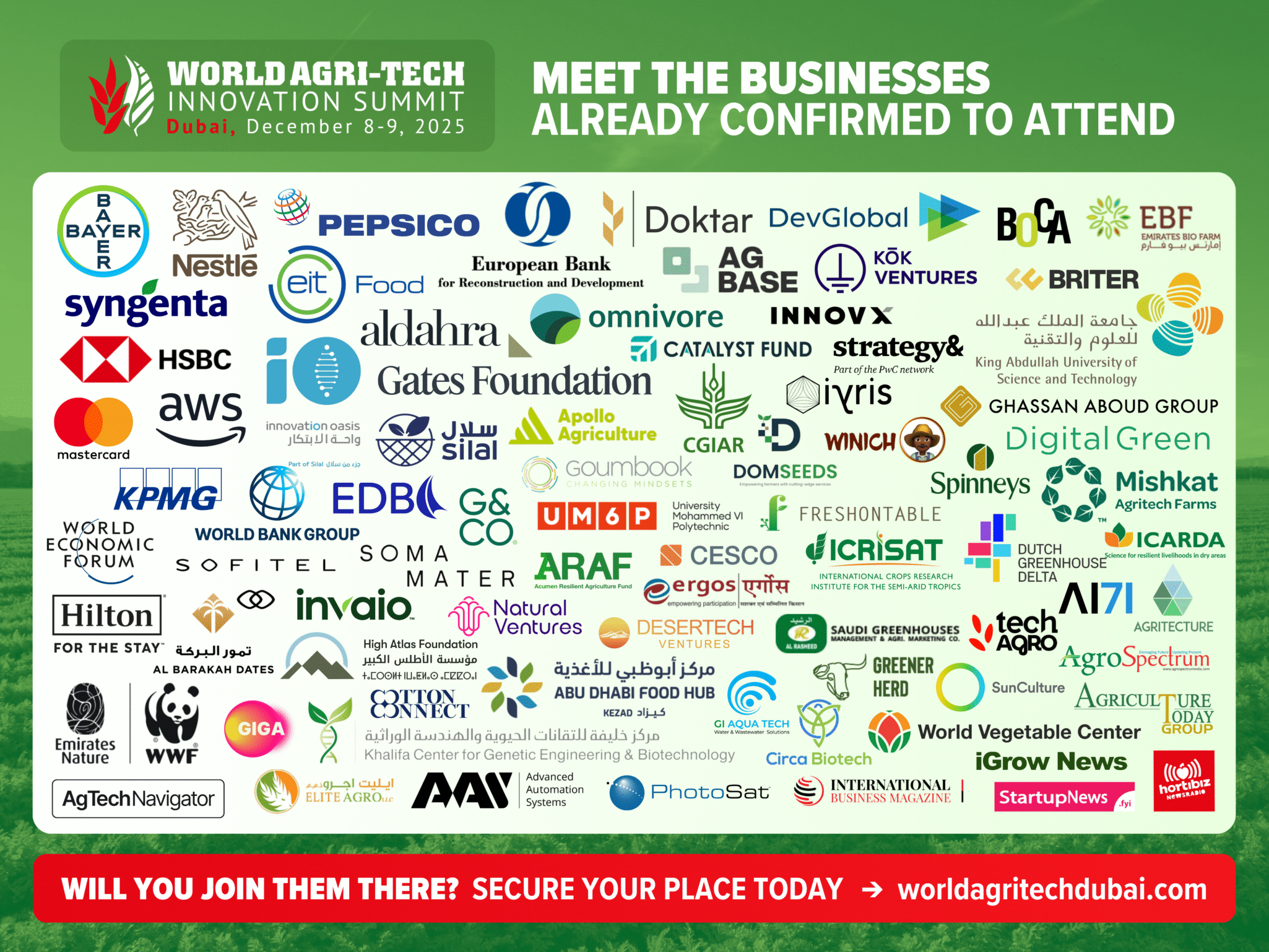

World Agri-Tech Dubai To Highlight Digital Inclusion as a Cornerstone of Smallholder Finance

Smallholder farmers, who produce up to one-third of the world’s food supply, remain among the most underfinanced actors in agriculture. Ahead of the World Agri-Tech Dubai summit, leaders from Mastercard, FMO Dutch Entrepreneurial Development Bank, Catalyst Fund, and CGIAR outlined how digital solutions are beginning to close this gap across Africa and the Middle East.

World Agri-Tech Dubai To Showcase Mastercard’s Value Chain Digitization for Market Access

Marie-Rose Mukahirwa, Senior Vice President at Mastercard, emphasized that digital inclusion is central to agricultural transformation. Through the Community Pass platform, Mastercard is digitizing agricultural value chains end-to-end, enabling secure offline transactions, digital payments, and verified transaction histories in regions with limited connectivity.

Farmers in Uganda using Community Pass have reported higher yields, better access to quality inputs, and price increases of up to 30% through more transparent digital marketplaces. Mukahirwa noted that these improvements strengthen farmers’ ability to withstand climate shocks and market volatility.

World Agri-Tech Dubai To Underscore FMO’s Call for Integrated Last-Mile Platforms

According to Marius Birkenhager of FMO, the most effective solutions for smallholder farmers address access to inputs, markets, and finance simultaneously. Remote sensing and satellite data now enable alternative credit scoring, sustainability verification, and targeted agronomic guidance—critical tools for lowering the cost of serving dispersed farmer populations.

Birkenhager stressed that digital tools must be paired with strong on-the-ground engagement to ensure adoption and trust.

Startups Driving Scalable Agri-Finance Models Across the Region

Catalyst Fund Operating Partner Maxime Bayen highlighted early-stage innovators building integrated financial and climate-resilient tools for smallholders. Examples include:

- MazaoHub (Tanzania): AI-powered precision farming and extension services.

- AgroSupply (Uganda): A savings-led model enabling farmers to pre-pay for climate-resilient inputs.

- Oko Finance (West Africa): Satellite-based crop insurance bundled with input credit for more than 2,500 farmers.

- Zebra Cropbank (Nigeria): Digital post-harvest storage enabling crop-backed lending.

These models show how fintech, insurance, and agronomy can converge to reduce risk for both farmers and lenders.

CGIAR Emphasizes Farmer-Centered Design for Technology Adoption

Gianpiero Menza, Senior Manager at CGIAR, highlighted that co-designed digital tools drive higher adoption rates. CGIAR research shows that “ambassador farmers” significantly accelerate local uptake of digital advisory services, mobile finance tools, and low-cost mechanization.

Menza cited examples from Morocco and Egypt, where blended digital finance pilots have increased yields by up to 27% and nearly doubled incomes.

Case Studies Demonstrate Tangible Farmer Gains

- Mastercard: Digitization of farmer cooperatives in Kenya and Tanzania through the MADE Alliance.

- Catalyst Fund: Oko Finance’s satellite insurance and Kenya’s Farm to Feed model linking farmers to new buyers.

- CGIAR: Egypt’s Milkup platform boosting milk production by 75% and increasing income per unit of feed by 90%.

These cases illustrate the measurable outcomes of integrating digital tools, advisory services, and financial innovation.

Panels During World Agri-Tech: Toward a More Inclusive Agricultural Finance Ecosystem

Speakers aligned on one message: smallholder financing is entering a transformative phase, powered by AI, digital identities, satellite-based credit scoring, and data-driven advisory tools. But success depends on ecosystem coordination rather than isolated initiatives.

Get your tickets for World Agri-Tech Dubai now.