Key Takeaways

- Vertical farming across the Middle East represents a USD 0.22B segment within the region’s USD 2.87B CEA grower market.

- The UAE and Saudi Arabia lead adoption, supported by food security mandates, mega-projects, and public-private partnerships.

- High energy costs, regulatory fragmentation, and labor shortages remain major constraints to scaling.

- Case studies such as Bustanica and Grow-tec demonstrate the region’s ability to deploy commercially viable, high-performance indoor systems.

- Growth through 2030 will depend on energy optimization, skills development, and increased affordability.

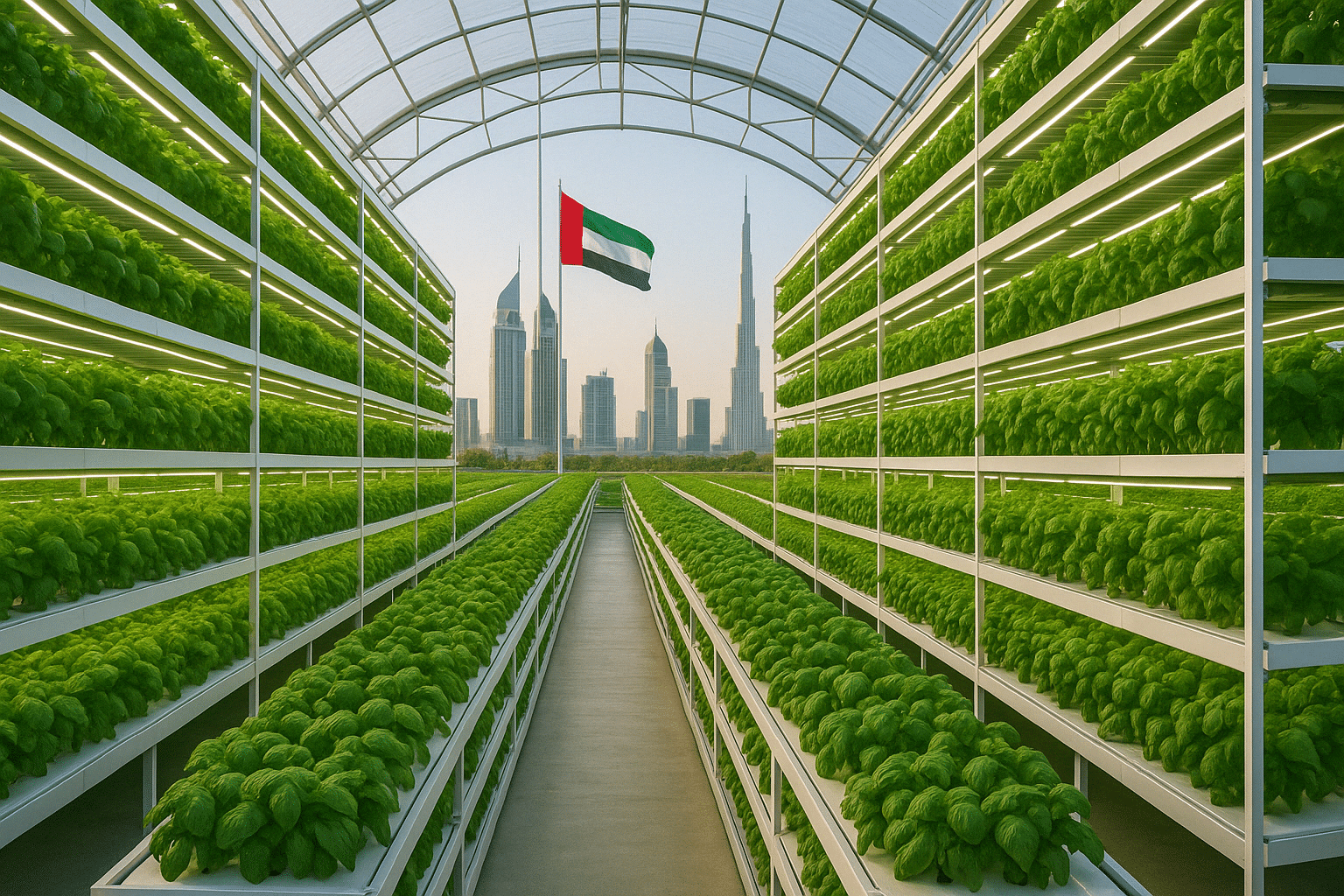

Vertical Farming Gains Momentum Across the Middle East

Vertical farming has transitioned from early experimentation to a meaningful—though still niche—segment within the Middle East’s controlled-environment agriculture (CEA) landscape. The combined vertical farming market across the region is valued at USD 0.22B, representing approximately 7.7% of the total indoor farming grower market. The UAE and Saudi Arabia remain the primary hubs, supported by strong policy frameworks and investment-led diversification strategies.

Government-driven food security priorities, dependence on imports, and the need for resilient supply chains have accelerated vertical farming adoption, particularly for high-value crops such as leafy greens and herbs.

What’s Fueling Growth in Vertical Farming?

Vertical farming growth across the Middle East is shaped by several structural drivers:

- Food security mandates, including the UAE’s Food Security Strategy 2051 and Saudi Arabia’s Vision 2030.

- Climate challenges, from extreme heat to water scarcity, making traditional production increasingly difficult.

- AI and automation, which are gaining traction in commercial operations across the GCC.

- Public-private partnerships, including multi-million-dollar MoUs with Dutch and Asian suppliers.

As technology costs fall and infrastructure improves, vertical farms are becoming strategically important assets for premium retailers, hospitality groups, and national distribution networks.

Case Studies Highlighting Regional Potential

Flagship facilities are helping demonstrate what is possible under Middle Eastern conditions:

Bustanica (UAE)

One of the world’s most advanced vertical farms, producing around three tonnes of leafy greens per day. The site uses 95% less water and operates 27 modular growth units across three floors. Energy represents up to 40% of its operational costs, driving efforts to integrate solar and optimize HVAC efficiency.

Grow-tec (GCC)

A fruiting-crops indoor facility delivering yields of ~790 kg/m² of tomatoes and ~1100 kg/m² of cucumbers annually. The patented multi-tier system operates with zero pesticides, 90% water savings, and significantly reduced land footprint. Early replication in multiple countries signals its commercial viability.

These examples illustrate that high-tech vertical farming can achieve meaningful productivity and resource efficiency when paired with the right technology and environmental controls.

Challenges That Continue to Limit Expansion

Despite strong progress, vertical farming growth is far from uniform across the region. Several challenges persist:

- Energy costs—particularly for lighting and HVAC—remain the single largest barrier to profitability.

- Skill shortages, with limited local capacity in hydroponics, automation, and facility operations.

- Regulatory fragmentation, especially around seed imports, biological inputs, and certification processes.

- Affordability constraints, with price-sensitive consumers limiting demand for premium indoor-grown products.

These factors help explain why vertical farming—while rapidly developing—still accounts for a small share of total CEA production.

Outlook: Selective Expansion, With Strong Regional Leadership

Between 2025 and 2030, vertical farming is expected to grow selectively across the Middle East, anchored by:

- Continued investment in the UAE and Saudi Arabia

- Increased deployment of energy-efficient technologies

- Local manufacturing of agricultural equipment

- Access to capital via sovereign funds and global investors

Vertical farming will remain a premium, innovation-led segment, but its role in regional food security and supply chain resilience is likely to expand as costs decline and regulatory frameworks improve.

Download the Full Middle East Indoor Farming Report

Get the complete market dataset, trends, and country-by-country analysis.

Access Live, Real-Time Market Intelligence

Track funding, partnerships, expansions, and facility builds across the region.

4 Comments