Key Takeaways

- Regenerative agriculture is expanding globally, driven by yield stability, soil health, and input cost pressures.

- Carbon markets remain concentrated in regions with established legal, financial, and MRV infrastructure.

- Adoption of regenerative practices does not automatically translate into carbon credit issuance.

- High verification costs, long contract durations, and transition-period risks limit farmer participation in carbon markets.

- The divergence reflects structural constraints rather than a lack of agronomic interest.

Regenerative Agriculture Is Spreading Faster Than Carbon Markets

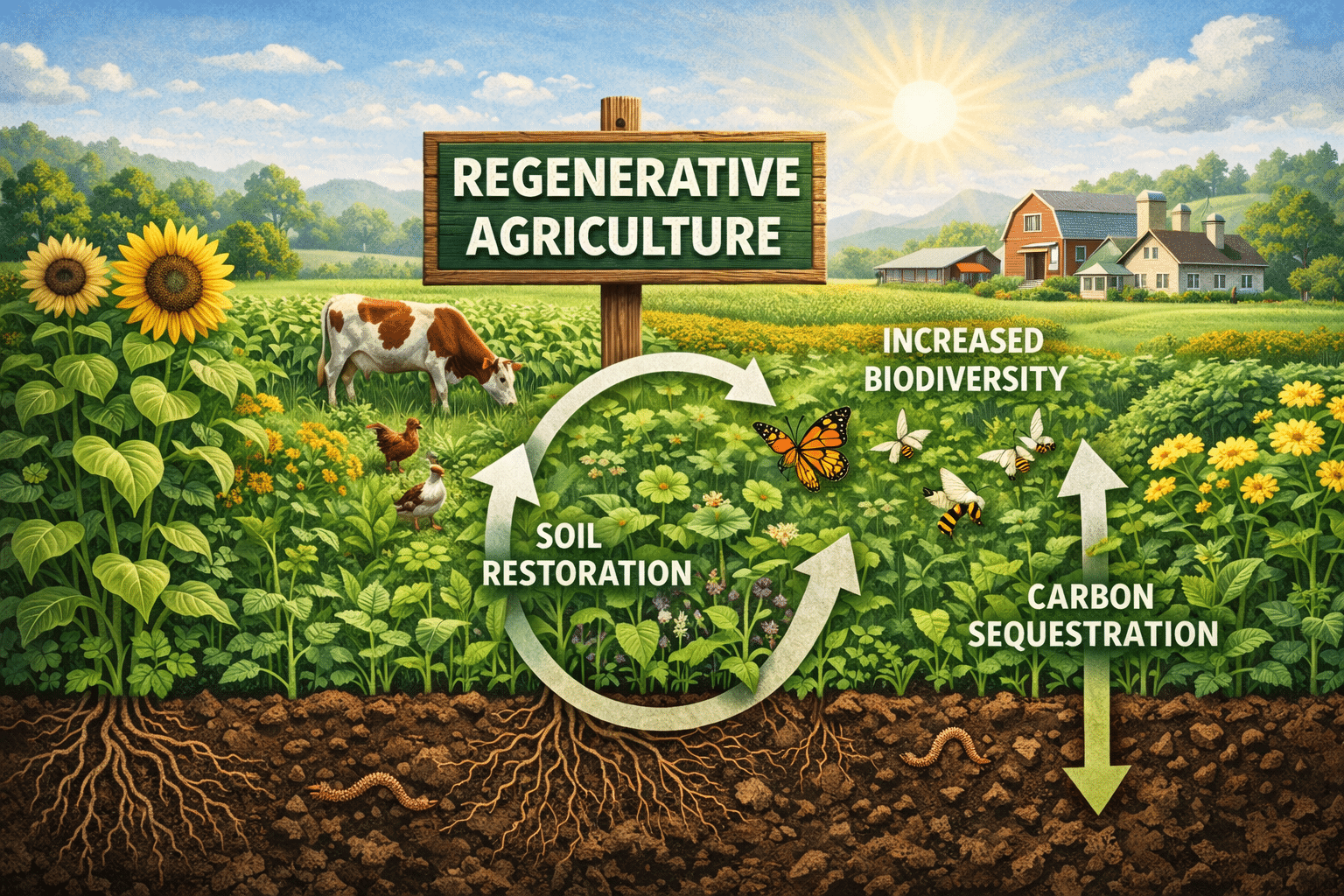

Regenerative agriculture practices—including cover cropping, reduced tillage, diversified rotations, and improved nutrient management—are being adopted across regions with very different economic and institutional contexts. In North America, Europe, Africa, Asia, and Latin America, these practices are increasingly used to address soil degradation, yield volatility, and rising input costs.

However, data captured in the iGrow Database shows that this widespread adoption has not translated into a parallel expansion of carbon credit issuance. While regenerative practices are visible across all regions, carbon market activity remains concentrated primarily in North America and Europe.

This divergence highlights a key distinction: regenerative agriculture is an agronomic response to on-farm challenges, while carbon markets are financial systems that require standardized measurement, long-term commitments, and verification infrastructure.

Why Carbon Credits Require More Than Practice Adoption

Carbon markets depend on measurement, reporting, and verification (MRV) systems capable of quantifying emissions reductions or removals with sufficient accuracy and consistency. These systems introduce costs and administrative requirements that often exceed the capacity of smallholders or fragmented farming systems.

In North America and Europe, farmers are more likely to operate within environments where legal frameworks, digital infrastructure, and financial intermediaries support carbon contracting. In contrast, in regions where land tenure is uncertain, farm sizes are small, or monitoring costs are high relative to income, carbon monetization becomes less viable.

As Agreena stated following the verification of its AgreenaCarbon Project under Verra standards, scaling carbon farming requires “robust data systems and long-term engagement with farmers to ensure credibility and permanence.” The company has emphasized that verification infrastructure, rather than methodology availability, is the primary limiting factor.

Economic Risk and the Transition Period

Another key reason adoption and credit issuance diverge is the transition period associated with regenerative practices. Research and field data indicate that farmers may face temporary yield declines during the first one to three seasons after changing practices. Without dedicated financial products to bridge this period, many producers are hesitant to commit to multi-year carbon contracts.

In public remarks on climate-smart agriculture programs, U.S. Secretary of Agriculture Brooke Rollins has noted that farmers “need risk-sharing mechanisms and predictable incentives” to adopt practices that deliver long-term environmental outcomes. This challenge is amplified in regions where access to credit is limited.

Structural, Not Agronomic, Constraints For Regenerative Agriculture & Carbon Markets

The iGrow Database makes clear that regenerative agriculture and carbon markets respond to different drivers. Regenerative practices expand where agronomic and economic pressures are immediate. Carbon markets expand where verification, capital, and contract enforcement are feasible.

As a result, regenerative agriculture is global, while carbon farming remains geographically selective.

Read the full data-driven analysis:

https://network.igrownews.com/c/igrow-market-reports/regenerative-agriculture-mapping-market-activity-capital-and-deployment

Stay informed on regenerative agriculture and carbon markets:

Subscribe to iGrow News newsletters at https://igrownews.com/subscribe