Key Takeaways

- Danny Bernstein argues AgTech remains capital-starved due to structural illiquidity and the absence of standardized financial tools.

- Simulation is useful but not sufficient; real-world grower engagement must shape product development from day one.

- Startups often over-engineer and under-commercialize, failing to build scalable sales models beyond early pilots.

- The Reservoir’s strategy includes digital secondaries and ETF-style exposure, avoiding dependence on M&A or IPO outcomes.

- Policy alignment and blended capital models are crucial for accelerating scale and workforce integration in the sector.

Danny Bernstein on the Missing Infrastructure in AgTech

Despite the growing attention on agricultural innovation, Danny Bernstein, CEO of The Reservoir, believes AgTech continues to suffer from a structural capital gap. “AgTech lacks the capital infrastructure that other sectors take for granted,” he says. “There are few institutional buyers, no reliable secondaries, and no standardized growth-stage vehicles.”

This lack of liquidity deters many investors—especially those unfamiliar with long product cycles and physical deployments. “Most venture investors hesitate because the risk profile is unfamiliar—multi-year validation, seasonal cycles, specialized buyers, and a low-tolerance environment for technical downtime,” Bernstein explains.

To address this, The Reservoir is building new investment structures such as bundled Special Purpose Vehicles (SPVs) and ETF-style exposure to multiple companies or technologies. “We’ve outlined models that combine digital secondary markets, bundled SPVs, and ETF-style exposure to create exits that don’t depend on billion-dollar acquisitions,” Bernstein adds. “Without liquidity tools tailored to physical innovation and long sales cycles, the sector stays starved for scale capital.”

Beyond Regulation: Designing Capital for Reality

While some advocate for regulatory changes like those enabling flexible crowdfunding in Europe, Bernstein believes that’s only part of the solution. “Flexible funding comes from matched design versus lighter compliance,” he notes. “Regulatory change could unlock incremental capital, but the real opportunity is to build a modern capital market from first principles.”

He highlights that U.S. solutions should focus less on retail crowdfunding and more on structured access to risk-managed vehicles: “In the U.S., we’re more focused on enabling structured liquidity—through platforms like Nasdaq Private Market or through new vehicles that aggregate exposure across crops, regions, or tech categories.”

Why Real-World Testing Matters, According to Danny Bernstein

AgTech companies are often torn between simulation-based validation and field testing. Bernstein sees a clear limit to lab-based approaches. “Simulation helps accelerate development, but real-world testing reveals the full picture—crop variability, environmental extremes, operator behavior, and edge cases that don’t appear in code,” he says.

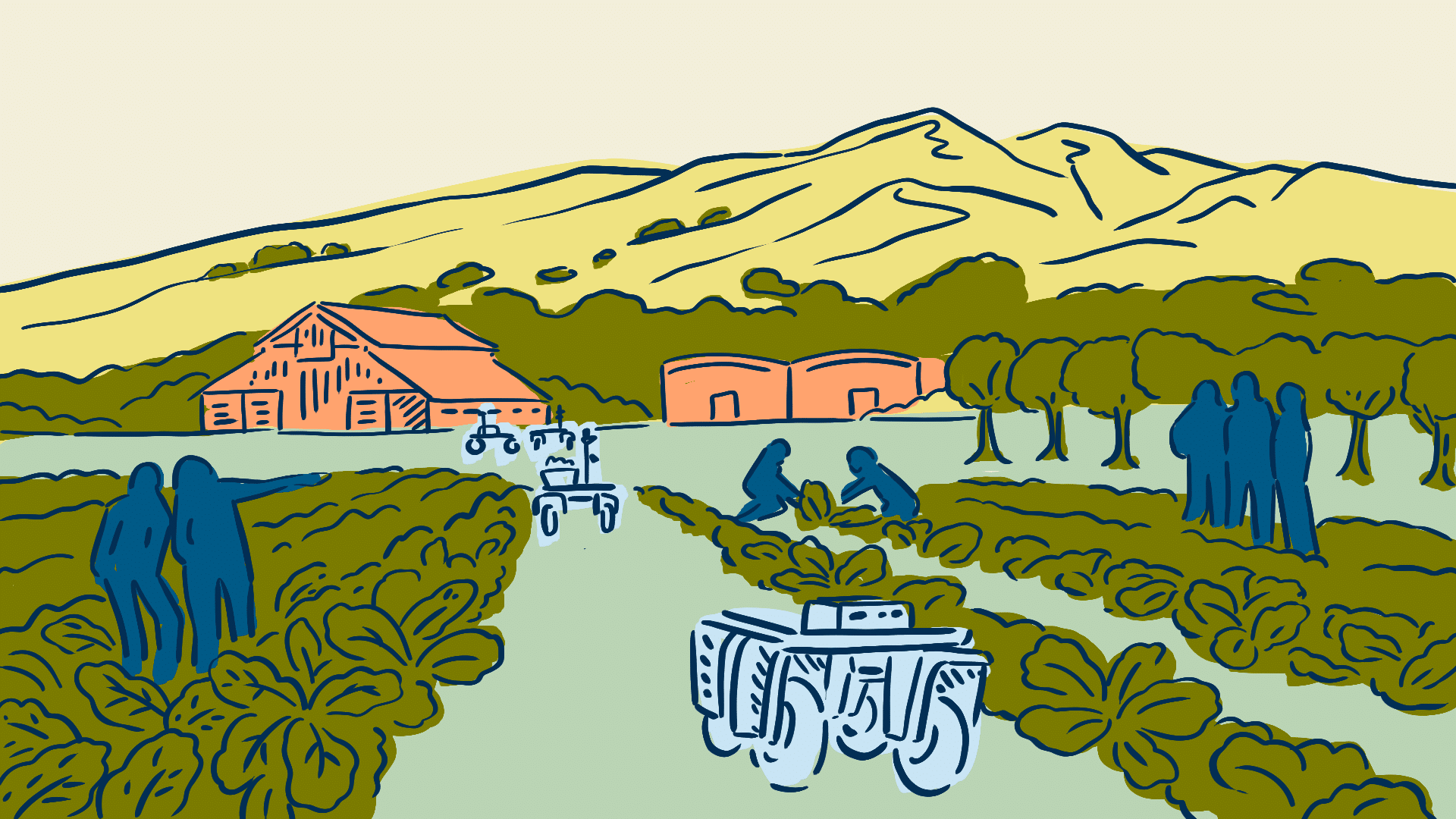

At Reservoir Farms in Salinas, startups are embedded directly into live production blocks managed by commercial partners. This environment enables faster iteration through Bernstein’s “80/10/10” product philosophy: “80% off-the-shelf parts, 10% customized, 10% invented.”

This balance minimizes engineering delays while ensuring practical value. “That approach gets machines into the field quickly while keeping iteration cycles fast. Grower input is continuous,” he emphasizes.

The Cost of Over-Engineering

Some startups, Bernstein warns, focus too heavily on building technically perfect solutions that fail to function in real-world farm environments. “Over-engineering shows up most clearly in companies with burn but no feedback loop,” he says. “Teams aim for theoretical precision while missing opportunities to validate against real constraints—dust, crop growth patterns, mechanical wear, and field logistics.”

He recalls seeing well-designed systems fail in the Salinas Valley due to misalignment with real conditions. “In specialty crops, a partial solution that works during harvest is more valuable than a perfect one that misses the window,” Bernstein says. “We encourage startups to launch early versions that deliver value on day 1 and improve through usage versus abstraction.”

From Pilots to Scale: Danny Bernstein on Go-to-Market Strategy

Beyond product performance, Bernstein places strong emphasis on commercialization strategy. “We ask how the company will scale from a single field to a regional operation,” he says. “Who services the machine? What does the sales motion look like across three different commodities? How do channel partners make money?”

He adds that successful founders have clarity on their long-term model: “They’ve also made deliberate choices about whether to build a direct field team, license to OEMs, or partner through integrators. They've spoken to a bunch of dealers.”

What matters most, he says, is the ability to grow efficiently. “The ones who’ve done the work can explain how they get from five growers to fifty without doubling headcount.”

Missteps in Pricing and Channel Strategy According To Danny Bernstein

Bernstein often sees AgTech companies stumble on go-to-market execution. “Many price based on cost or feature count, rather than value created or labor replaced,” he says. In parallel, he warns against diluted positioning: “Some try to be a full-stack solution too early, which dilutes focus.”

He also points out that founders often assume early pilots guarantee scale. “In reality, pilots are often used for benchmarking or comparison,” Bernstein notes. “We’ve seen better results when companies lead with narrow, high-impact use cases—like harvest assist in berries or auto-thinning in leafy greens—and build out from there with channel partners who already have grower trust.”

Aligning the Ecosystem: The Reservoir’s Model

For Bernstein, a thriving AgTech sector requires deep alignment between startups, growers, and capital. “It looks like what we’re building at Reservoir Farms,” he says. “Startups validating side-by-side with growers on commercial acreage, surrounded by the equipment, next-gen workforce, and data required to prove value.”

This setup shortens development timelines and increases investor confidence. “The result is shorter feedback loops, more investable milestones, and a clear bridge from prototype to scale,” he adds. “A healthy ecosystem removes friction. It rewards usable tech, viable economics, and speed to impact.”

Policy Influence and Public-Private Collaboration

Looking ahead, Bernstein sees The Reservoir taking a more active role in shaping policy and regulatory frameworks. “We’re already engaging with Western Growers, federal and state agencies, elected officials, and local governments to create environments where innovation can thrive,” he says.

This includes regulatory innovation as well as capital structure changes. “That means shared autonomy standards, multi-county deployment clearances, and pathways for modular certification,” Bernstein explains. “On the capital side, we’re pushing for structures that blend public co-investment with private capital—so field trials, workforce integration, and early deployment can be subsidized where appropriate.”