Key Takeaways:

- European indoor farming firms raised approximately $123.82 million between 2024 and early 2025, with GrowUp Farms and IGS receiving the majority share.

- New funding rounds in 2025 included AISPRID, AVISOMO, Voltiris, and a $143M JV involving Planet Farms and Swiss Life.

- Investors are increasingly focused on operational efficiency and long-term profitability over scale or rapid expansion.

- Strategic consolidation, mergers, and joint ventures continue across the sector in response to regulatory and market pressures.

- Greenhouse operations remain heavily reliant on EU subsidies, particularly in France and the Netherlands.

Investment Patterns in Europe Indoor Farming Investment

Funding Volumes and Key Beneficiaries

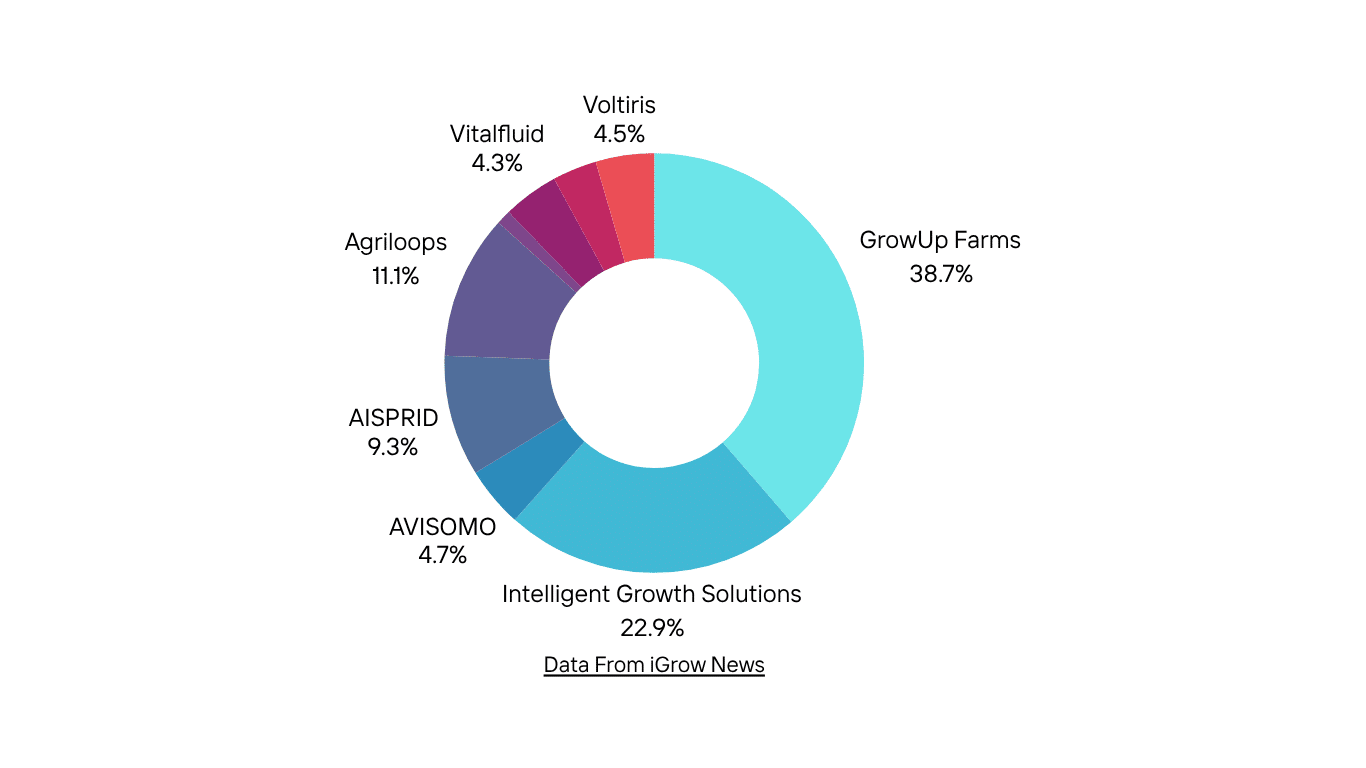

Between 2024 and early 2025, Europe vertical farming investment activity totaled approximately $123.82 million. A significant portion of this capital was directed toward GrowUp Farms and Intelligent Growth Solutions (IGS), which together represented nearly three-quarters of all disclosed funding during the period.

Other companies that attracted investment in 2024 included:

In early 2025, AISPRID closed a funding round worth $10.9 million, AVISOMO raised $5.45 million, and Voltiris secured $5.26 million. Separately, a substantial joint venture was announced between Planet Farms and Swiss Life, with Swiss Life committing up to $143 million in growth capital.

Europe Indoor Farming Investment Trends

Shift Toward Efficiency and Profitability

There is a growing investor focus on cost control, especially regarding CAPEX and OPEX reduction. Companies are actively restructuring their operations to align with expectations around long-term viability. This includes energy efficiency upgrades, integration of renewable power sources, and optimization of logistics.

Sector Consolidation and AgTech M&A 2025

In parallel, the sector is experiencing consolidation. Notable examples include:

These moves reflect a maturing ecosystem where strategic partnerships and mergers are being used to improve resilience, extend service offerings, and respond to increasingly complex regulatory and economic environments.

Compared to some North American markets, European indoor farming investments emphasize operational sustainability and regulatory alignment over scale-driven growth.

Greenhouse Funding Europe: Role of Public Subsidies

Common Agricultural Policy (CAP) and National Support

In the greenhouse segment, particularly in countries like France and the Netherlands, funding is significantly underpinned by public subsidies. Key support mechanisms include:

- EU’s Common Agricultural Policy (CAP)

- Horizon Europe

- The European Innovation Fund

- National climate and green transition funds

Subsidies target various operational and infrastructure priorities including:

- Renewable energy adoption

- Greenhouse heat subsidies

- Digitalization and automation upgrades

In France, an estimated 70% of greenhouses benefit from subsidized heat, while in 2017, 81% of CAP expenditure in the Netherlands went to direct payments, highlighting the dependency on consistent state support.

Structural Dependence on Public Support

Stakeholders across the region consistently emphasize that without government backing, many greenhouses would struggle to remain operational. High energy costs and increasingly stringent regulatory frameworks make it difficult to maintain profitability without intervention.

Policy initiatives like the Temporary Crisis and Transition Framework (TCTF) have been introduced to streamline access to aid, particularly for smaller operations, though concerns remain about long-term financial stability.

Reports from entities such as the French High Council for the Climate stress that environmental improvements often introduce new costs, which either need to be absorbed through pricing premiums or subsidized through public channels.

Concluding Notes On European Indoor Farming Investments

Europe’s indoor farming investment landscape in 2025 is defined by selective capital deployment, a strong push for cost efficiency, and increasing institutional support. While early-stage funding continues, particularly for automation and energy-related technologies, the long-term viability of greenhouse and vertical farming ventures remains closely tied to regulatory incentives and subsidy frameworks.

For more on the investment trends, partnerships, and technology developments shaping this sector, view the European Indoor Farming Report.