Key Takeaways:

- Homestead Capital USA LLC names Luke McCarthy as director of its credit team.

- McCarthy will spearhead loan origination to grow the firm’s agricultural lending business.

- McCarthy brings over 15 years of experience in agricultural financing and loan management.

- Homestead Capital manages more than $1.6 billion in equity and credit assets nationwide.

- Appointment aligns with the firm’s strategy to increase private credit services for the agricultural sector.

Homestead Capital Strengthens Agricultural Lending Team with Industry Expert Luke McCarthy

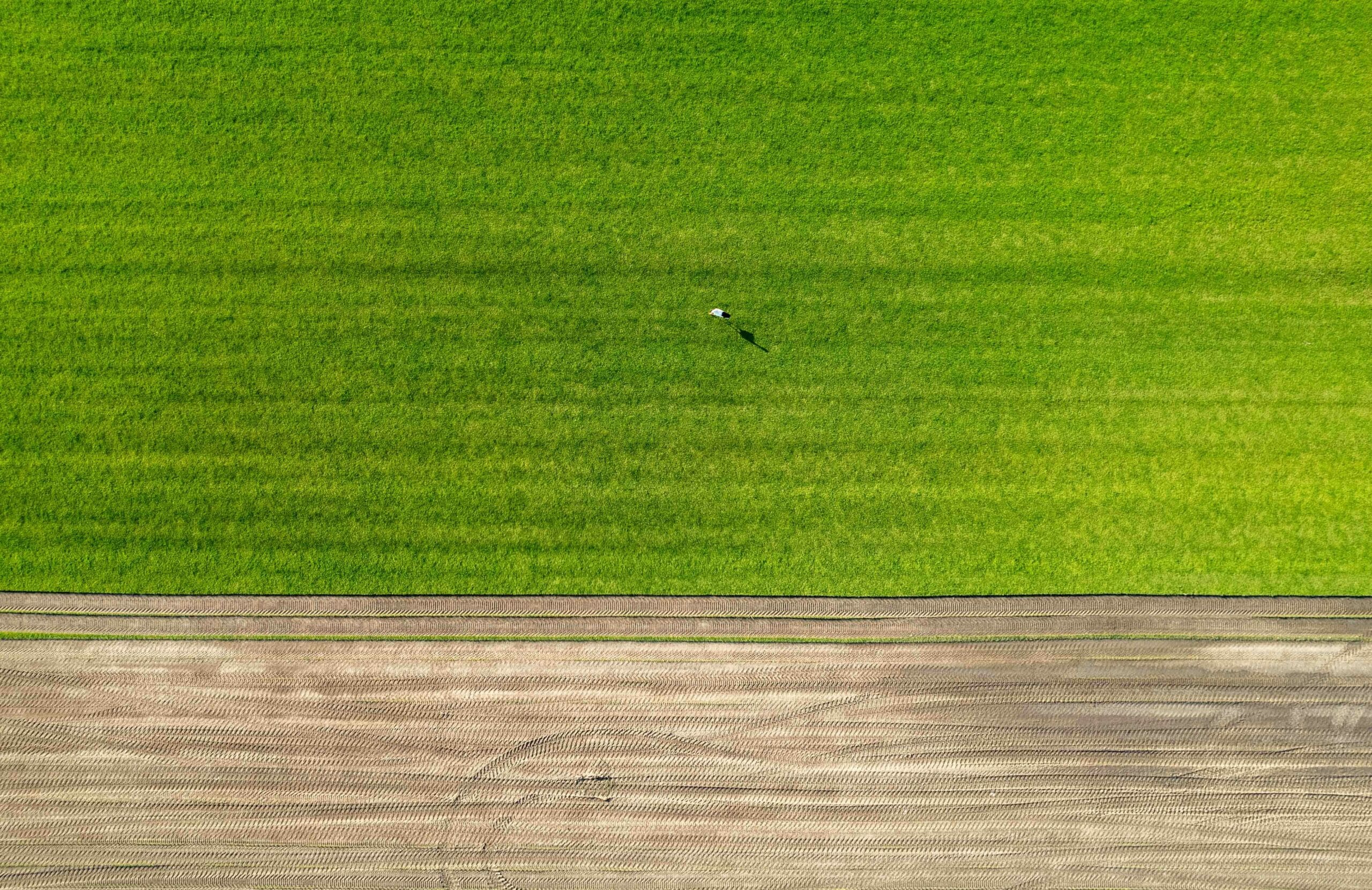

Homestead Capital USA LLC, a diversified investment manager specializing in farmland investments and financing across the United States, announced the addition of Luke McCarthy as director within its credit division. McCarthy will lead the firm's loan origination efforts, aiming to accelerate growth in agricultural lending and foster deeper relationships within the farming and agribusiness communities.

San Francisco-based Homestead currently oversees more than $1.6 billion in equity and credit assets, serving a variety of institutional clients, including pension plans, endowments, foundations, insurance companies, and family offices.

Extensive Background in Agricultural Finance

Luke McCarthy joins Homestead Capital with over 15 years of extensive experience in agricultural finance, having specialized in credit analysis, collateral valuation, loan syndications, and due diligence. His expertise covers nationwide agricultural financing, enhancing his ability to support Homestead's expanding operations and build strategic relationships across the U.S.

Prior to joining Homestead, McCarthy served as executive director at PGIM Real Estate, where he originated and managed agribusiness and farm real estate loans totaling over $1.3 billion. Earlier in his career, he held the position of vice president of loan syndications at Rabo AgriFinance, managing syndicated loan portfolios and overseeing deal execution across the central and western U.S.

Homestead Capital Strategic Expansion of Agricultural Lending

Justin Burns, managing director at Homestead, expressed enthusiasm for McCarthy’s appointment, emphasizing how his experience aligns with the company's goals:

“As sophisticated investors continue to explore alternative asset classes and as we continue to expand our private credit business, Luke's expertise in agricultural finance and his first-hand farming knowledge will be of great benefit to Homestead clients,” said Burns.

Deep Agricultural Roots and Education

McCarthy brings personal insight into farming operations, having grown up on his family’s pear, apple, and cherry farm in Oregon, where he remains actively involved. His academic credentials further reinforce his qualifications: McCarthy holds a bachelor's degree in applied economics and management in finance from Cornell University, a master's degree in agricultural economics from Purdue University, and an MBA from Indiana University's Kelley School of Business.